Our Approach

The Westmoore Group's investment approach is predicated upon the following three themes:

- Principal Minded Investing

- Borrower Affordability

- Conservative Loan Structure

Principal Minded Investing

The Westmoore Group lends as a principal. As such, the company intends to retain a meaningful equity state in all loans originated. Although the Westmoore Group may rely on brokers and intermediaries for its pipeline, all investments made by the company will be approved by its internal investment committee and all employees of the Westmoore Group will be compensated based on the performance of each transaction, not on volume. Furthermore, no investments will be approved based on set guidelines or fitting a box. Every investment will require independent thought, thorough analysis and stringent underwriting from Westmoore Group professionals.

Borrower Affordability

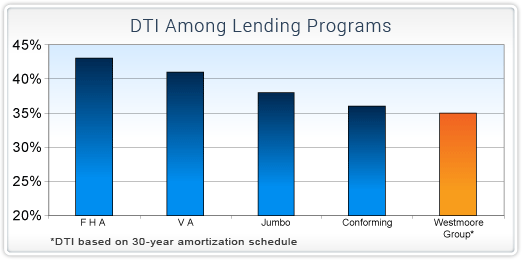

Although aggressive and predatory lending were largely responsible for creating the housing bubble, the U.S. consumer's penchant for "dreaming big" exacerbated the problem of easy money provided by Wall Street and the Government Sponsored Entities. The Westmoore Group will not provide a loan to any borrower that cannot afford it and will take a strict approach towards approving all borrower applications. Borrowers will typically need to demonstrate a Debt-to-Income ratio ("DTI") less than or equal to 35% based on a 30-year amortization schedule. Although the company does not require a minimum FICO score, the 35% DTI criteria is stricter than most national loan programs as demonstrated in the chart below.

Furthermore, all claimed income on the potential borrowers' application must be verifiable and documented and a borrower must have a clean balance sheet that is not burdened by excess consumer debt. Last and most important, a borrower must embrace the idea of purchasing a home within his or her means.

Conservative Loan Structure

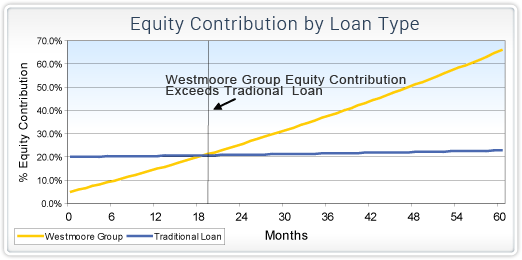

The Westmoore Group mitigates risk by structuring 10-15 year amortization schedules into loans resulting in rapid de-leveraging each month. This benefits the company, while helping the borrower save for his or her future by contributing additional equity to pay down the loan every month.